What is it?

The “Ex-Tarifário” is an initiative of the Brazilian government created to reduce the import tax, applicable to products that do not have a national similar and that meet certain criteria.

In this way, it encourages imports by facilitating access to innovative foreign solutions in the local market and protecting local suppliers of similar solutions in Brazil.

An ex-tariff consists of a temporary reduction of the import tax rate for an imported product in case specific requirements are met. With the reduction of the import tax rate the government levels down the cost of the imported good and could damage the domestic industry. Therefore, the first and most important requirement is that the object of the regime (product or merchandise being imported) is not produced in Brazil and has no national equivalent.

Currently, granted ex-tariffs are valid for two years from the date of concession and can be renewed once this period is over, if the conditions at the time of concession have not changed (if there are still no local competitors supplying a similar solution). In the past, the reduction could range from 2% to 0%, and currently it is 0%.

Why is it important for Swiss companies?

If granted an ex-tariff, the import tax for a particular product will be reduced from its original rate (of up to 16%) to 0%, strongly affecting the nationalized cost of a product.

There are five different taxes incurring in a cascading effect on imported products in Brazil (see Annex 1).

The tax credit system depends on the tax regime the importer adopts, which can be based on “real” or “presumed” profit (for more details regarding taxation in Brazil consult our Business Guide)

From the taxes and duties above, the import tax (or I.I.) is the first one to be applied, hence determines the costs of the following taxes, and is the only one that consists of pure cost for the importer. The I.I. cannot be offset or credited in any way, regardless of the tax regime the importer adopts.

As many Swiss products are innovative and prone not to have equivalent products manufactured in Brazil, they are strong contenders to an ex-tariff. With Swiss products also being positioned as “premium” in the Brazilian market and having their cost in national currency increased by the exchange rate fluctuation, an ex-tariff in place could increase their competitiveness significantly.

As shown in Annex 2, an ex-tariff can result in an immediate cost reduction of approximately 22% in an import operation of a product (hospital drainage equipment, NCM 9018.9099) that originally had an import tax of 16%. (see Annex 2, Import simulation with or without Ex-Tariff in place).

How to obtain it?

An electronic application has to be filed in the Electronic Information System (SEI, or Sistema Eletrônico de Informações) with the Secretariat of Industry, Commerce and Innovation Development (SDIC, part of the Ministry of Economy) by a Brazilian entity, which can be a company, a partner or an association. The construction of the claim is vital – it has to comprise technical and logistical information to form a detailed dossier that will prove that there are no similar products manufactured nationally as well as set out the benefit of the good to the applicant and the local market.

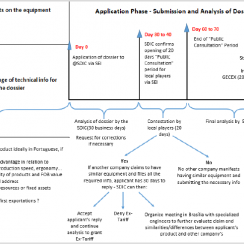

How long does it take?

An average of 2 to 4 months, after the introduction of the electronic system, but subject to delay if the dossier is inconsistent or if the application is contested. Therefore, the time invested in

the construction of the claim is essential to ensure a smooth and successful process. (see Annex 3: Timeline of Ex-Tariff Claim; Overview incorporating latest ordinances).

Key aspects

For a successful ex-tariff claim it is vital to:

- Carefully analyze all technical documentation referring to the product (folders, catalogues, certificates, etc.);

- Ensure that the application dossier comprises all aspects that ponder in favor of the benefit (such as increase in innovation/competitiveness/productivity in the different economic segments, incorporation of new technologies, number of jobs generated, etc.), and;

- Highlight the characteristics that make the object of the claim unique in Brazil.

Previously, an application for such benefit could only be submitted by the importer of a product destined to his use. Now, it is applicable to the good. This is positive for the foreign companies that manufacture the product because now they can secure the benefit and extend it to all their distributors, partners and even clients who import directly. However, within this new rule, once an ex-tariff is granted, any (competitor’s) product that is able to match the details described in the approved ex-tariff benefit can use it and clear their goods with the reduced import tax rate.

The aspects described above emphasize the importance of constructing the dossier ensuring the correct balance, so that:

- The dossier is adjusted to the correct NCM Code (classification code used in Mercosur that is similar to the HS Code ) and clearly outlines the benefits of product to the local industry, avoids contestations and delays concerning technical specificities with the classification as well as comparisons with local/national similar products;

- The description of the ex-tariff position granted ideally only benefits the applicant’s product and not the product of its international competitors;

- The text is not too specific to impede the possibility to use it for new versions of the same product/upgrades or new generations.

In case of ex-tariffs granted for medical equipment/devices, the company that imports the goods is still additionally required to have the Anvisa operational license corresponding to the class of risk of the product.

Recent changes

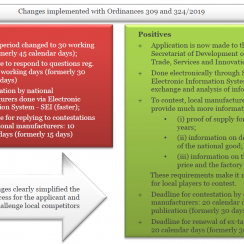

With the changes implemented in the legal framework by means of Ordinances 309 and 324/2019, dated June 2019 and August 2019, deadlines for the analysis of the process have been reduced and the contestation by actors of the local industry has to obey stricter standards in order to be considered. (see Annex 4, Recent changes in the Ex-Tariff regime claim).

As stated before, in some cases the analysis can take longer and last up to 7 months – particularly relevant when concerning equipment for large industrial plants with high costs and timed project milestones. In special cases of goods arriving in the country before the concession of the ex-tariff benefit, a legal advisor can be consulted to assess the possibility of submitting a legal injunction, allowing the importer to clear goods out of customs with the reduction of the tax before final response from SDIC.

Considering the relevance of such regime for Swiss companies to tackle Brazil with their USPs and the peculiarities exposed above, the Swiss Business Hub Brazil encourages the engagement of a local expert to evaluate the feasibility, as well as to create the dossier and oversee the entire process in Brazil on behalf of the Swiss company, ensuring a successful outcome.

Should you be interested in obtaining an ex-tarifario and reducing the import tariffs paid by your Brazilian customers, please do not hesitate to contact us.