It is invisible to the naked eye, radioactive and present in the atmosphere in minuscule amounts. Its name is 14C and it is a carbon isotope. The ETH spin-off, Ionplus AG, founded in 2013, is focussed entirely on this unassuming isotope. Ionplus is a pioneer in the area of 14C carbon dating, a process for dating materials that contain carbon. The process is used in archaeology, environmental and marine research, materials science, biomedicine, forensics, geology as well as atomic energy.

The only provider of a fully functional laboratory

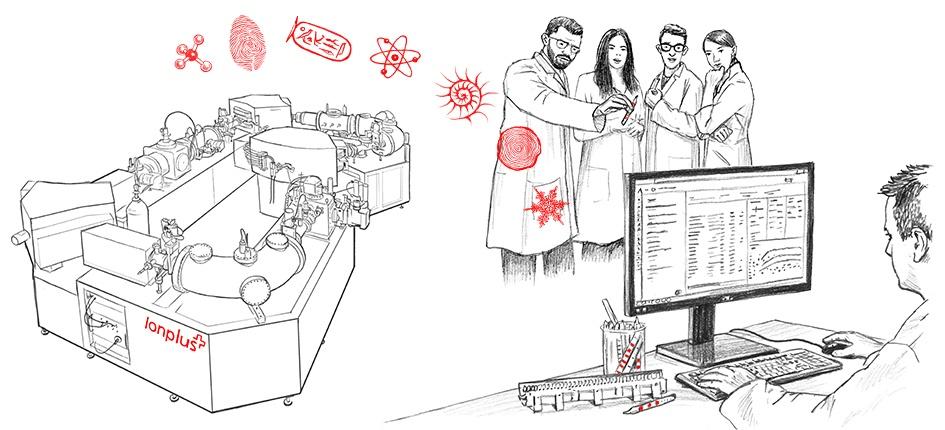

This process requires a range of different machinery. The most important is an accelerator mass spectrometer. Before measurement, the sample must be prepared using various measures, chemically treated and converted into pure carbon (graphite). Ionplus is one of three companies that develops accelerator mass spectrometers. But, in contrast to its competitors, the spin-off provides machinery for the entire process chain, not just for measurement. It also supplies software for data evaluation, including databases, and in-depth know-how. This makes Ionplus the sole provider of a fully functional laboratory.

Export challenge

The sales market of Ionplus mostly consists of research companies from all over the world. Delivering to international customers always involves additional challenges: besides cultural differences and other ground rules in every buyer country, there is also a general risk of payment default. Another difficulty is procuring liquid funds, which was particularly difficult when Ionplus was initially starting out. CEO Joël Bourquin explains: “To even build an installation, we need around CHF 700,000 up-front. As this involves a term of 1.5 years in each case, it makes liquidity extremely important for the company. This is problematic for a start-up, as there are virtually no possibilities for obtaining cheap financing.” SERV cover can provide relief in such a case. This takes over Ionplus’ payment risk in its relationship with the bank, which gives Ionplus access to bank products, such as an advance payment guarantee in this case. This means that Ionplus does not have to provide any additional collateral to the bank. “In the start-up phase, SERV was the only financing option. It was essential for our growth”, adds Bourquin. These days, the company sells four to five installations, worth around CHF 2 million, every year.