08.10.2020 How to Work with a Trade Partner on a Cross-Border E-Commerce Platform in China

Due to the COVID-19 pandemic, the enforcement of social distancing, lockdowns and other measures has driven up the demand for online shopping in China. Get an overview on the players in the Chinese cross-border e-commerce ecosystem and learn how to choose the right trade partner.

Opportunities for Swiss companies

Opportunities for Swiss companies

Recently, China’s two biggest e-commerce giants, Alibaba and JD.com, handled 136.51 billion US dollars-worth of sales through their platforms on the occasion of China’s major annual shopping event, known as “618” (because it falls on June 18). JD.com had a total transaction volume of 269.2 billion yuan (37.99 billion US dollars), an increase of 33.6% year on year, while Alibaba said gross merchandise value (GMV) stood at 698.2 billion yuan (98.52 billion US dollars).

Growth will continue in the Chinese e-commerce market and this ongoing development will offer huge opportunities to Swiss companies. However, the most challenging question is how to successfully enter a large Chinese e-commerce platform. This article illustrates the functions and services provided by third-party agencies, i.e. trade partners (TPs), as well as the cost framework, in order to enable Swiss companies to gain a better understanding of how TPs support foreign companies operating on Chinese cross-border e-commerce platforms.

Important players

Important players

Players in the Chinese Cross-Border E-Commerce (CBEC) Ecosystem

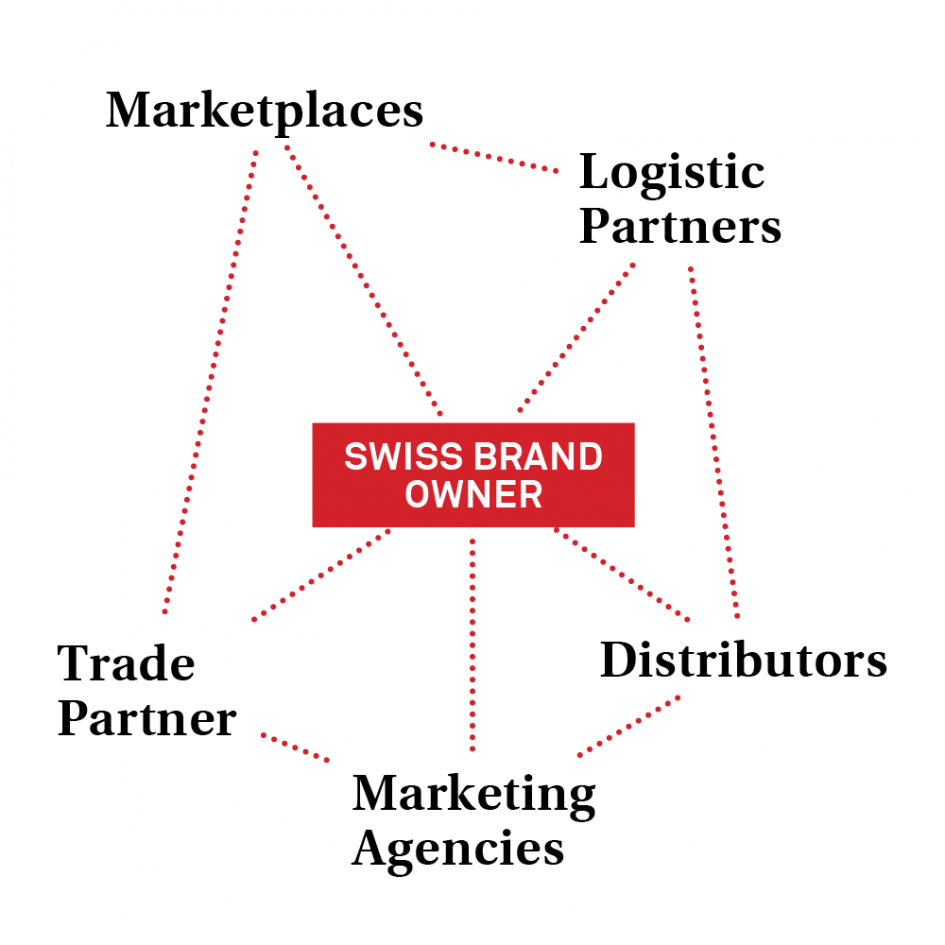

China’s e-commerce has a unique landscape and ecosystem. Who are the key players in the Chinese CBEC ecosystem? For a visualization of the ecosystem, please see the image gallery below.

Market places: Currently, the four top CBEC platforms in China are:

- TMall Global: Operated by Alibaba Group. China's largest cross-border online marketplace.

- JD Worldwide: Belongs to JD.com, the second largest CBEC platform after Alibaba. It has its own one-stop logistics division.

- Kaola: Acquired by Alibaba from NetEase.com. It used to be the biggest CBEC platform.

- VIP: Ranking at 4th place, specializing in luxury goods. However, it has seen a decline in sales performance as newcomer, Pinduoduo, is catching up and showing strong momentum.

Foreign Brands: Particularly for CBEC, the brands and products are from abroad and are promoted either by the brand owners, a commercial partner (an importer/distributor) or a foreign trade promotion agency.

Distributors: Traditional distribution partners cover all types of distribution network buildup.

Logistics Partners: From cross-border bonded warehouse to domestic door-to-door delivery, logistics is at the core of the supply chain.

Marketing Agencies: They assist the brands to implement their marketing strategies according to actual scenarios.

Trade Partner (TP): The trade partner role developed as CBEC evolved and integrated all functions of the industry chain into a single, comprehensive service provider. In other words, a trade partner (TP) is a third-party company that helps foreign or Chinese companies operate their daily e-store or channel business on e-commerce platforms by offering diversified multifunctional services.

.

Service Content

Service Content

Trade Partners’ Services

If we refer back to the definition of a TP, it performs multiple roles, including those of a marketing agency, distributor, logistics partner and operations agency. So how does the trade partner perform those services?

TPs normally assign 8-10 staff members for each flagship store for their services, which are categorized into 7 modules:

Brand Consulting:

- Implementation and optimization of market research

- Platform consulting

- Product planning—suggestion of product selection and creation of popular store products

- Sales forecast

Platform Application:

- E-store design and decoration

- Brand’s visual design

- Visual positioning and communication

- Professional photography and video creation

Marketing Promotion:

- Store marketing planning and advertising proposal

- Establishment of promotion mechanisms and platform sponsorship activity

- Marketing campaign in multiple O2O channels, such as KOL live streaming

- Title optimization, sorting optimization, pull-down prompts and related search engine optimization

Platform Operation:

- Daily operation and maintenance of the e-store

- Coordination of internal relations

- Data management and application

- Assistance in marketing activities and supply chain management

Supply Chain:

- CBEC logistics solutions consulting

- Order fulfillment

- Shipping and customs clearance

- Warehousing and logistics (bonded warehouse or direct mailing)

TMall Global and JD Worldwide have their own CBEC warehouse and logistics teams, and normally foreign brands work with these CBEC platform giants directly. Some TPs with competency in logistics can also recommend other CBEC warehouses and domestic logistics providers, which generally are cheaper than Alibaba and JD.

Customer Services:

- 365 days x 12 hours consecutive online customer service

- Customer classification management

- Pre-sale, in-sale and after-sale service

- Complaints handling

Omnichannel Distribution:

- Integrated e-commerce platform (e.g. top 4 CBEC platforms, etc.)

- Vertical e-commerce platform (e.g. Kidswant, Jumei, etc.)

- Social e-commerce (e.g., WeChat, TikTok, QQ, etc.)

- E-stores owned by hypermarkets (e.g., Watsons, Suning, Sam’s Club, etc.)

- Online to Offline (O2O)

- Omnichannel price control

In addition to these business functions, there is another very important role performed by the trade partner: All foreign entities operating on CBEC platforms are required to have a local Chinese company to provide a guarantee. In case of any quality-related problems, the Chinese authorities can trace and find the responsible entity in China. Most TPs are willing to provide the guarantee, given that they are also working as a distributor, unless the products are of very high value and there is too much uncertainty.

Overall Cost Structure

Overall Cost Structure

So how much does it cost? The overall cost structure of running an e-store in China is rather complex, taking into account the comprehensive services provided by the TP and the use of CBEC platforms:

CBEC Platform Costs: Paid to the CBEC Platform

- Warranty deposit charged to each e-store (fixed price, returnable)

- E.g., TMall Global requires 25,000 US dollars and JD Worldwide requires 15,000 US dollars for normal products and 30,000 US dollars for certain products like luxury goods, milk powder and nursing care.

- Annual platform usage fee (fixed price, non-returnable)

- E.g. the fee charged by TMall Global is dependent upon the merchant’s registered primary category, see link.

- JD Worldwide charges 1,000 US dollars for each product category.

- Sales commission fee (a real-time transaction fee) = (product price + logistics service fee) x applicable commission rate

- Logistics service fee charged per item (real-time cost)

- Financial transit service fee

- Alipay service fee on TMall Global: 10% of total cost (product price + logistics service fee).

- JD Worldwide currently does not provide a financial transit service, so there are no fees charged.

TP Service Costs: Paid to the Trade Partner

- Monthly service fee (fixed price, non-returnable)

- Sales commission fee based on actual sales value (real-time cost)

The cost varies among different trade partners, as defined by the service contract. The monthly service fee covers all the services under the service framework as mentioned above. Any marketing costs are not included and are borne by the foreign e-store owner.

(Third Party) Costs of Marketing and Branding Activities: Paid to Relevant Service Providers

- All kinds of marketing materials

- Marketing campaigns and sales promotion tools on TMall Global are all paid resources; the resources on JD Worldwide are partially paid

- O2O marketing and branding activities can work with multiple partners. Sometimes the TP can be the general service contractor.

Internal Administrative and Maintenance Costs of the Foreign Brands:

- Operating costs

- Labor costs

- Other possible costs

Chinese Customs Clearance Fee

- No specific cost is charged by Chinese Customs for customs clearance handled by a TP.

Each cost charger will only manage the costs and communicate with the e-store owner (the foreign entity) with regard to the services rendered. There will be no cross-management or overlapping functions in this matter to avoid confusion and problems.

Why work with a Trade Partner?

Why work with a Trade Partner?

Why a Trade Partner is Needed and How to Choose the Right One?

There is a need when a foreign brand has:

Difficulty in Operating

- No local operations team

- Lack of knowledge of consumer profile

Difficulty in Marketing

- Limited knowledge of marketing tools

- Branding problems

Lack of Data

- No Chinese marketing data

- Lack of tools for data collection and analysis

No Service Team

- No local logistics team

- No local customer service team

How to Choose the Right Trade Partner?

Both TMall Global and JD Worldwide certify TPs if they meet certain conditions. Certification depends on the platform’s individual standards, not an official government designation. To qualify, TPs must have CBEC and logistics experience, a multilingual staff, an ERP system, and IT interface integration capability. Additional qualifications include established international offices and the capacity for overseas business development, as well as owning cross-border warehousing. While the process ensures a certain degree of utility and reduces the number of fly-by-night agencies, certification alone is no guarantee of quality or trustworthiness.

It is important for any in-demand Swiss entity to choose a TP with extensive experience in the Swiss company’s industry, as the TP should have an understanding of the regulations governing particular types of products. For example, a TP specializing in cosmetics should have knowledge of the rules concerning government registration of such products, while one in food products would have experience in storing and distributing perishable goods. Similarly, TPs active in certain foreign regions should have in-depth knowledge of the regulations, supply chains and business cultures of specific countries (such as Switzerland or other nearby European countries), and provide the relevant language skills and support systems. An effective way to identify a trustworthy TP is through recommendations from leading CBEC platforms that have their own TP management team who are responsible for TP resource maintenance, TP service framework building, TP performance evaluation and ranking, TP recommendation and TP communication assistance. However, the liabilities and authorizations will be mostly dependent on the framework of the service contract signed by the e-store owner and the trade partner. CBEC platforms will not assign or choose a TP for the e-store owner but only provide recommendations and guidance. For example, Alibaba has a TP Ranking list published quarterly: see link for Q1 2020; JD has what it calls a “JD Worldwide Service Union” which provides a performance evaluation every half year. Based on these rankings, the foreign e-store owner can get a general idea of who the star trade partners are.

It is not easy for a Swiss brand to enter the Chinese market, especially with these new and complex technical and commercial operational practices on CBEC platforms. If you would you like to start doing e-commerce in China, please get contact our experts.

Support from S-GE

Do you have any questions about the cross-border e-commerce ecosystem and how trade partners work in China? If so, we would be happy to support you. Please get in touch with our consultant for China, Daniel Bont.