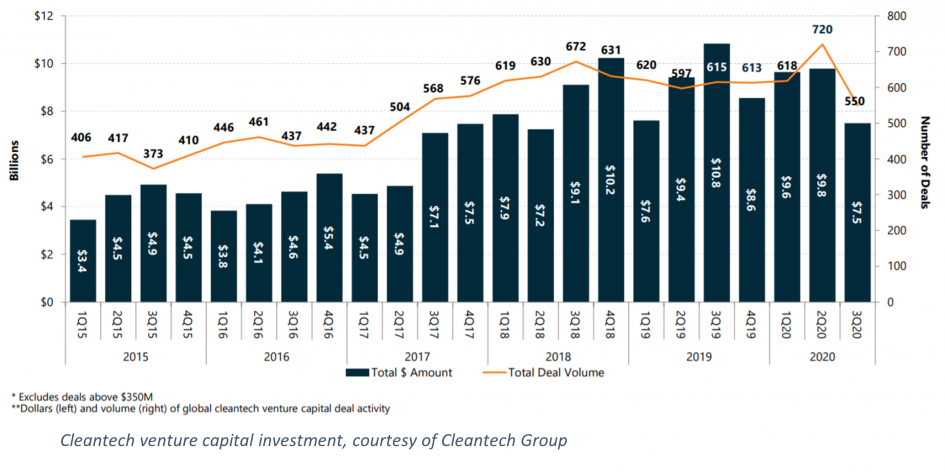

2020 has been a rollercoaster of a year. As projected, after a steady first half, the effects of coronavirus had an impact negative on investment into cleantech globally. After a strong second quarter in 2020, where many deals were already in development prior to the pandemic, the third quarter experienced a sharp decline of 23.6% in overall deal volume and 23.5% in deal amount. This decline occurred across all 5 sectors except Transportation & Logistics, which bucked the trend with investment growth driven by deals in mobility services and electric vehicles. The figure above shows this drop.

Smart Cities

Coronavirus crisis has reinforced the necessity of preparing for public safety, health crises and pre-empting potential disruptions to city life. Cities around the world are taking a wider view on what it means to be “smart”, and increasingly embracing next-generation technologies to put distance between their daily operations and emerging risks to them. In China, the $380 billion Xiong’an New Area, slated to be the new home of many government departments relocating out of congested Beijing, has barrelled ahead with its plans to build a cutting-edge, zero impact metropolis from the ground up. 5G-connected buses and big data infrastructure to model the city’s consumption and supply chains are under development, and autonomous highway vehicles are already in place. In the US, cities are adjusting to the new Covid-19 normal by redefining mobility. Minneapolis, MN has launched new mobility hubs offering more low-carbon options to citizens in transit by placing micro-mobility resources in populated areas and in Portland, OR, start-up Ride Report is helping the city to map and coordinate micro-mobility resources.

Switzerland, too, has found itself on the leading edge of smart city development. Zurich and Geneva were ranked as the third and 7th “Smartest” cities, respectively, in this year’s Smart City Index by IMD. Zurich has successfully implemented connected streetlights which are lit only during transit, and local innovator Elektron has teamed up with SBB, the electrical utility to provide traffic management. Geneva stands out with its comprehensive network of smart parking sensors directing drivers to open (or opening) spots and reducing congestion.

Circular economy

A further shift to circular economy business models represents an opportunity for significant cost, projected at between $340 billion and $380 billion per annum in the EU alone. Circular economy business models can apply to all industries, so this section will focus on a few critical sectors.

The worsening plastics crisis is forcing surrounding industries to consider circular business models. This year saw multiple corporate partnerships with high emitters, and project finance into chemical plastic recycling. In August, Quantafuel and Ramboll partnered to deliver a full-scale industrial chemical recycling plant for plastics in Denmark. To enable markets for recycled plastics innovators and incumbents are piloting tracking and accounting systems. In February, Proctor & Gamble announced plans to pilot packaging featuring a digital water mark to track where its plastic packaging ends up. Similarly, the fashion industry has begun to adopt tracking tools to enable repair and reuse markets. In July 2019, EON, developer software to connect digital identities of connected apparel, partnered with H&M, Microsoft, Target and Waste Management to launch the CircularID project. The project will pilot a supply chain tracking system, providing consumers with information about origin and authenticity. Circular fashion business models present an opportunity to retain up to $560 billion lost to fashion waste every year.

In Switzerland, uptake for the circular economy model has mostly been in waste management. Switzerland has achieved a recycling rate of over 50%. However, the country is one of the highest waste producers per capita in Europe. In February 2020, the Circular Economy Transition and Impact Hub Switzerland announced the 27 start-ups to participate in the ‘Circular Economy Incubator’, a three month program to support early stage companies developing solutions to reuse, repair, resell and refurbish. Cohort companies include clothing rental innovators, TEIL Style and Oïoïoï.

Hydrogen

Globally, 2020 has seen green hydrogen beginning to take off. With potential as a low carbon energy vector, the colourless molecule could account for 24% of global final energy demand by 2050. To date, the market has been inhibited due to technical, regulatory and demand constraints. 2020 has seen countries allocating large pools of hard capital, with nations such as Germany and Portugal committing billions for infrastructure build up. At the regional level, Europe approved a EU-wide hydrogen strategy, illustrating the increased support from developed countries, with over 70% of global GDP now linked to hydrogen roadmaps. And indeed, innovation is recognized by industrials as a key part of addressing green hydrogen hurdles. Mature start-ups including Hydrogenious and Sunfire are now partnering with global industrial corporates including Paul Wurth, Neste, Hyundai and Mitsubishi to address some of the cost and technical hurdles. Looking to the coming year, industry is now calling for more supportive regulation to incentivise large developments and to create a competitive, lucrative market.

Like the rest Europe, Switzerland intends to play a major role in the hydrogen industry, but with a particular focus on developing green hydrogen for mobility. Hydrospider, a Swiss joint venture between H2 Energy, Alpiq and Linde has taken a leading role in Europe. Its first commissioned electrolysis plant has a capacity of 2MW, is now the largest in the nation. Swiss hydrogen Innovation is largely mobility focused, with players such as EH Group Engineering and Swiss Hydrogen looking to mature and sell internationally. Bucking this trend, 2020 Switzerland saw its first public hydrogen refuelling station open, with plans to bet heavy on hydrogen for trucking. Also this summer Hyundai, announced the deployment of first 10 hydrogen trucks, and is planning to put 1,600 hydrogen trucks on Swiss roads by 2025. Swiss corporates and start-ups recognise that national build up is required if they wish to have an influential role on the rest of Europe in the next 5 years.

Agritech

The global agritech investment ecosystem is benefitting from two main tailwinds in 2020. Firstly, it is has grown as a destination for venture capital investment as increasing digitalization, decentralization, and transparency in the supply chain has reduced development and adoption cycles, and increased the VC-friendliness of agricultural innovation. Secondly, the Covid-19 supply chain shock has led agrifood chain operators to look for ways to improve supply chain agility, flexibility, and resilience. With a growing understanding of agriculture’s role in the climate crisis, leveraging technology to make agriculture more profitable and sustainable has become a priority for corporations, governments, and investors.

The Swiss agritech ecosystem is centered around companies which have often grown out of Switzerland’s strong University R&D centers. This leads to many companies with value propositions relying on cutting edge technology, such as EcoRobotix farm robot or Cyanoguard’s toxin sensors for food products. Another example is SwissDeCode, a developer of real-time food authentication, compliance and safety using DNA detection. The company counts alumni from universities in Lausanne and Geneva who have translated their research into a solution providing farmers fast and actionable information about the food they are producing to speed up the time between harvest and payment.

Advanced Manufacturing

Next generation technologies are fuelling the growth in advanced manufacturing, with a goal to automate and improve precision and efficiency. Termed industry 4.0, corporates and governments alike are supporting its advancement in a bid to stay competitive in the global market and counteract the effects of external disrupters such as Covid-19. In 2020, the U.S’ National Science Foundation announced a $40 million fund to drive innovation in manufacturing thorough both research and seed grants, whilst also encouraging innovative companies to join Manufacturing USA® to fill in gaps in its ecosystem. In June 2020, the European Commission announced a partnership proposal to drive innovation in artificial intelligence, data and robotics. China, at 28%, leads globally in manufacturing output, with Japan, South Korea and Germany included in the top 10, as well as leading in the robotics revolution. With its Made in China 2025 initiative announced in 2020 to drive smart manufacturing, China is determined to retain the number one spot in manufacturing.

Switzerland, meanwhile, has been placed in the top 25 countries poised to benefit from industry 4.0 with third global ranking in readiness due to available drivers of production. Although not part of the EU, swiss University of Applied Sciences is in partnership with the EIT Manufacturing consortium to exchange technical expertise on advance technologies. Similar to other countries, Switzerland’s SATW has established an industry 4.0 expert group to develop a national framework. This is necessary to facilitate multi-disciplinary engagement and research cooperation between different industry players. Swiss innovators, No-Touch Robotics and Matriq, received grants from Venture Kick through its 2020 program to develop their business structure. 9T Labs has also secured seed funding to finalize its industrial mass 3D printing solution.

New materials

The development of new materials continues to enable better and more environmentally friendly solutions in downstream applications across sectors and policy makers continue to recognize the importance of new materials development. In the EU, Advanced Materials remain a key enabling technology, and R&D continues to attract funding through the EU’s Horizon 2020 program. Potential for materials discovery and development continues to improve as techniques such as synthetic biology, AI and process automations are increasingly adopted – all of which are helping to shorten the time to identify, produce and launch new materials. Checkerspot and Kebotix both raised funding this year on the back of their materials discovery platforms. Application of new materials is driven by downstream demand in several areas. A renewed interest in industrial efficiency, hydrogen processing and carbon capture applications is supporting investments and partnerships to develop new materials for separations, with the potential for Metal-organic Frameworks becoming more apparent. Nanomaterials are increasingly finding applications in coatings targeting corrosion resistance with several innovators raising $10million+ rounds this year including Nelumbo and ActNano. Meanwhile, commitments from large building materials producers including Heidelberg and more recently LafargeHolcim are encouraging application of new low-carbon building materials, with LafargeHolcim further ramping up its partnership with Solidia for low carbon cement earlier this year.

Materials innovators in Switzerland benefit from the EU’s policy towards new materials development, with many supported by Horizon 2020 and Climate-KIC programs. Kick Start, a swiss early-stage start-up accelerator, provides additional support with cement and concrete emerging as a key theme. As part of the programme, Holcim Switzerland and low-carbon cement innovator, Neustark are engaged in a joint material test program. Holcim Switzerland and Mobbot are jointly working on the integration of recycled building materials into 3D printing technology. Several swiss materials innovators are active in other global in-demand areas. Multi-material developer, MultiWave Technologies, are involved in numerous EU funded projects, while UniSieve recently announced a $4.6 million round to scale-up its MOF-based separation technology. Meanwhile, Fluid Solids and NaturLoop are both scaling new bio-composite materials.

Summary:

The long-term impact of COVID-19 will be seen as the next few years play out. But with climate change now at the forefront of national agenda’s globally, there is no doubt innovation will continue to hold strong. As commitments including Amazon’s $2 Billion Climate Pledge Fund and Germany’s $10 billion hydrogen expansion strategy continue to pour in, for start-ups, capital, partnerships, and growth will be attainable.